Buying a home in Santa Clarita can be a stressful but equally rewarding experience. We asked our clients what advice they would give when beginning the process of buying a home. Here’s what they had to say:

- Talk to a Lender: When speaking with a lender, you can find out how much buying power you posses. It also allows you address any issues, such as credit repair. You cannot start to look for homes, if you do not know what you qualify for, or if you are currently aren’t ready to buy. Knowledge is power.

- Weigh out ALL Expenses: When buying a home we tend to hyperfocus on principle, taxes, and insurance. What a lot of home buyers dont consider is the extra expenses of maintaining the property. For example the HOA payment, how much it costs for utilities, or gas if your commute is extended.

- Have a 1, 5, 10 year plan: Is the “perfect home” going to suit your needs in the next 1, 5, or 10 years? Do you plan on staying in the home that long? Or do you plan on keeping it as an investment property later on? These are all things to consider. So while a three bedroom condo works for your needs now, will it suit your needs in the future? If no, can you afford another home that does? Focusing on short on long term goals will help you make a more informed decision when making a home purchase.

- Wants vs Needs: Although having a bathroom you can park a boat in sounds like a dream come true, it doesnt mean it is always practical, or that you can afford it. When searching for a home make a list of Wants vs. Needs. Take pictures of the home’s you like and cross reference which homes meet the most of your needs versus your wants.

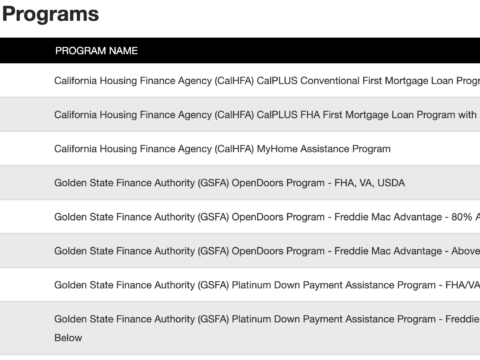

- Ask Questions: Do you understand what all of the disclosures your signing mean? Do you understand the difference between a conventional and FHA loan? If you dont know, or dont understand ask questions. If your lender, or agent are unwilling to help you fully understand the entire process of buying a home, fire them. There are plenty of experienced professionals who are willing to walk you through this process step by step.

As you can see there are many things to consider. Speaking with a lender to understand your buying power, credit, and type of loan you have is a great first step. Considering all expenses of home ownership from loan payments to how much utilities will cost will ensure a less stressful homeownership experience in the future. Lastly, consider the difference between a want and a need. If you are thinking about buying a home in Santa Clarita, or are curious what your home is worth, give us a call here.